It is discussed everywhere. In hard copy, in the coffee shop, and on the Internet: 2015 will not be the year that 2014 was.

Class III milk prices averaged $22.34 per cwt in 2014, the highest year ever, and $4.35 per cwt. higher than 2013’s $17.99.

How well each farm will fare through the coming year of substantially lower milk prices will be heavily influenced by the financial health of the farm going into this year. Cash or near-cash reserves will be tapped.

Evaluating assets

Cash is cash, but what is near-cash? Here we are looking at the Current Assets (CA) of the farm business. These include cash, savings, pre-paid expenses, accounts receivable, crop and feed inventories, supplies, and any market livestock such as bull calves and steers; items that will be used in the coming year to produce crops and milk.

So how do we evaluate the farm’s cash position, or liquidity — the ability to buy what is necessary to grow crops and make milk and pay the bills — when they are due? Three simple measures: current ratio, working capital, and working capital to gross income. These are calculated using the farm’s balance sheet.

Current ratio

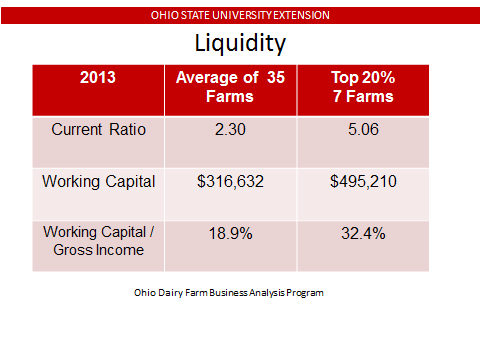

On the adjacent chart, compiled from real farm numbers of real farms participating in the Ohio Dairy Farm Business Analysis, we are comparing the current assets to the current liabilities of the farm.

Current liabilities (CL) include any bills the farm owes including the “usual” monthly bills and any other bills owed including credit cards. CL also includes balances on lines of credit, and the principal due on any term debt in the next 12 months.

So after we divide CA by CL, we would like to see a current ratio of at least 1.5, which means there is at least $1.50 of current assets for every $1 of current liabilities. Higher is better!

Working capital

This one is about as simple as it gets. CA minus CL. It needs to be positive, and the bigger the better.

How big is enough? Read on.

Working capital compared to gross income: Now we take the working capital and compare it to the gross income generated by the business.

We would like to see working capital of 25 percent or more. Is this all cash? No, remember that we are looking at all of the current assets.

For dairy farms, a great deal of working capital will be tied up in feed inventories and prepaid expenses as well as cash.

Looking at these measures for the 35 Ohio dairy farms that completed their farm business analysis for 2013 (Table 1), all farms and the top 20 percent of farms had excellent current ratios (CR), but the top 20 percent have a CR more than twice as high as the average of all the farms.

Both groups of farms also have large, positive working capital figures, but when we take that next step of comparing working capital to gross income, it is clear that the top 20 percent have the advantage going into 2015 with working capital of 32.4 percent of their gross sales compared to all farms with working capital of almost 19 percent.

These are some important, basic numbers that each farm should know for their farm business.

Get the numbers

If your current system does not allow this sort of analysis, 2014/2015 is a prime time to join the Ohio Farm Business and Benchmarking program.

There are two ways to participate depending on what records and information you kept in 2014. If you have good records, you can start right into an analysis of 2014. If existing records aren’t so good, you can work toward an analysis of 2015.

Cost is minimal due to generous grant funding, at only $100 per farm for either method.

Visit http://farmprofitability.osu.edu to view past analyses and find out more about Ohio’s program.

Contact us to talk about what would work well for your farm at 330-533-5538 or shoemaker.3@osu.edu.